It ensures the money reaches the intended bank which can then internally route it to the correct account using the recipient’s bank account number.

Chase incoming wire routing number code#

The SWIFT Code of the receiving bank/branch is the most important piece of information that is needed in case of international wire transfers. Institution number and transit code in Canada.Note that each country has a different way of routing funds to the correct account, for example: This identifies the bank, branch and account without requiring a branch code or routing number. For example, when sending money to Europe, U.A.E., etc., the account number is substiuted by an IBAN number. When appropriate, instead of the beneficiary bank account number you may need to provide the IBAN (International Bank Account Number).This identifies the bank and branch at the receiving institution. ABA (American Bankers Association) or Routing Number: If sending money to the USA.The recipient’s bank account number and type (e.g., checking, savings etc).Typically, you will need to visit your bank and fill out a form with the following information: In other words, money is transferred from one bank or financial institution to another, wherein the sending and receiving bank follow a set of financial protocols to ensure the funds are deposited to the intended recipient, without having to rely on having a common banking infrastructure between the sender and the recipient's banks, even if they are in different countries. #1: What is a Wire Transfer?Ī wire transfer is an electronic transfer of funds from one person or corporation to another business or individual. Here are the top 10 things you need to know about wire transfers, so you can start sending payments without stress. Whether you’re sending money to your family overseas or sending international business payments, it’s important to know if your wire transfer services are in good hands. Whether you need to pay your suppliers, pay your contractors or pay employees abroad, how much do you really know about wire transfers, the actual process of wiring money, and wire transfer risks?

Sort Codes are 6-digit numbers used for domestic transfers in the United Kingdom which identify the bank and the branch where a bank account is held.Wire transfer is one of the most popular methods of moving money worldwide. They're mainly issued by banks in the Eurozone, but other countries are starting to adopt them as well. IBANs are international bank account numbers that identify the country, financial institution, and individual bank accounts.

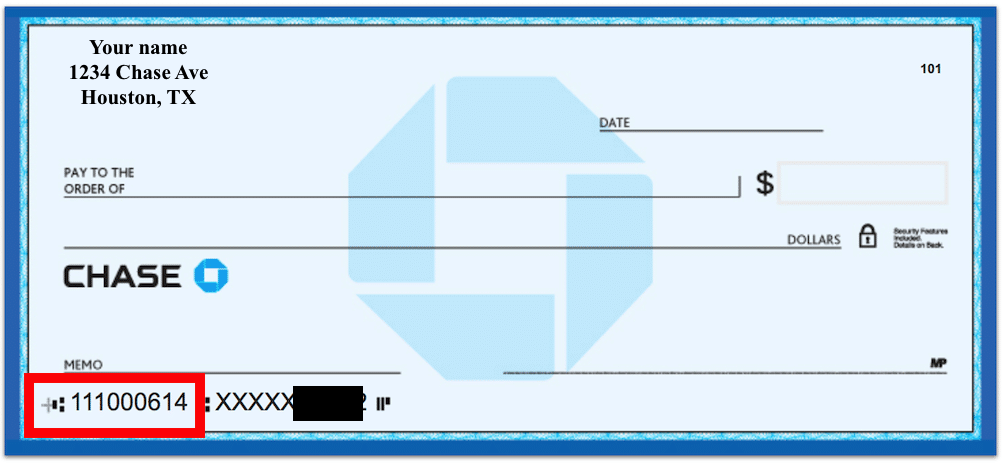

Unlike routing numbers, these codes are used for international payments. SWIFT / BIC codes are 8 or 11-digit codes that uniquely identify banks and financial institutions worldwide. These are not required when making payments outside the United States. Routing numbers are 9-digit codes used in the US to identify banks when processing domestic ACH payments or wire transfers. What exactly are these acronyms, and what are they used for? Well, all of them seemingly do much of the same thing which is to help banks identify where your money needs to go when being transferred, but each is required in specific situations because different countries and banks have different processes and requirements. If you're planning to send or receive money through your bank, you will likely come across unfamiliar terms such as routing number (ABA), SWIFT / BIC code, IBAN, and sort code. How are routing numbers, SWIFT / BIC codes, IBANs, and sort codes different?

0 kommentar(er)

0 kommentar(er)